EIS and SEIS are Government approved schemes designed to help qualifying companies raise money. The schemes work by offering tax reliefs to individual investors who invest in the qualifying company. The tax reliefs are slightly different under each scheme, but basically the investor:

- Can claim income tax relief relating to the original investment;

- If the investment is successful, there is no capital gains tax liability on an exit; and

- If the investment fails, some further income tax relief is available.

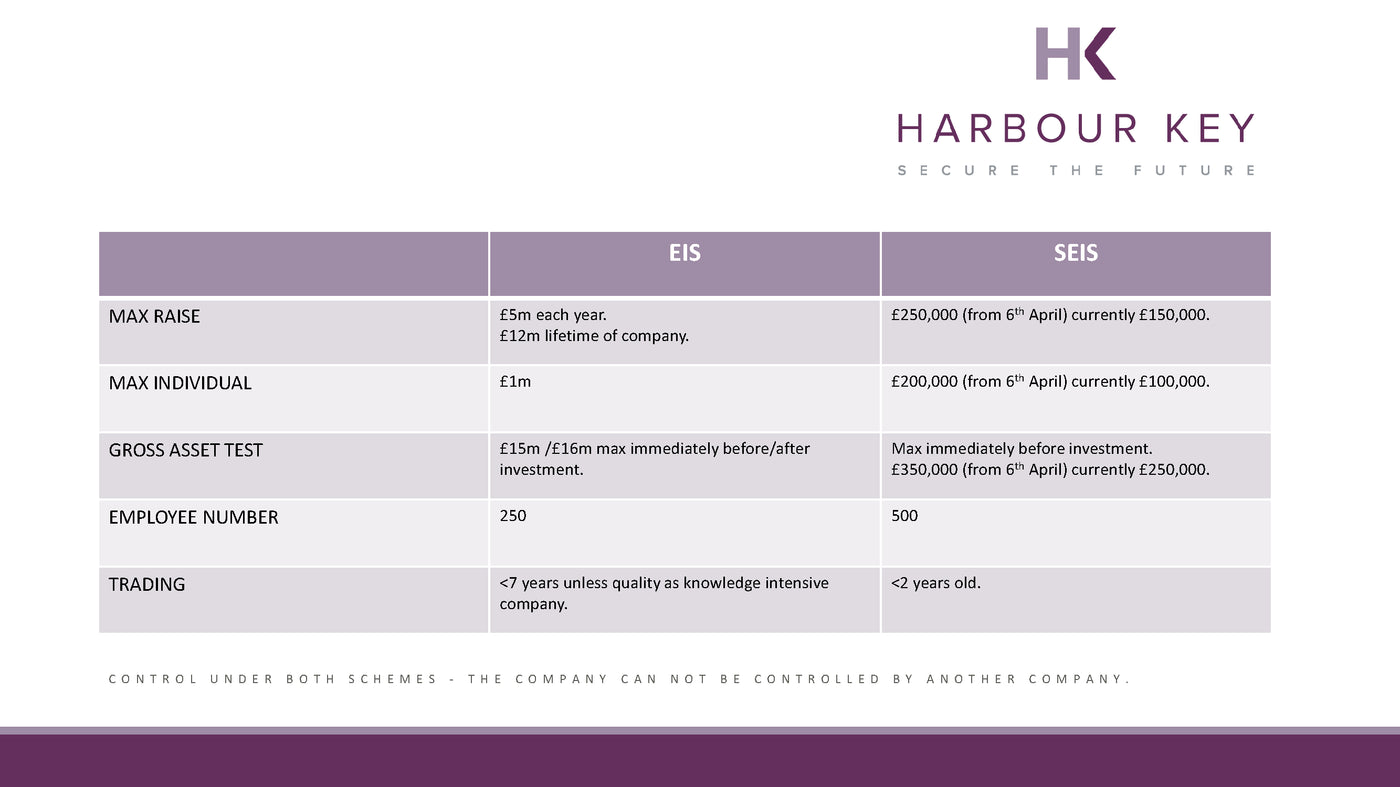

The qualifying conditions for the Company are different for each relief and the main conditions are summarised in the table above, however both share the same disqualifying trading activities.

The Finance Act 2018 introduced an important new condition that has to be satisfied in order for either EIS or SEIS relief to be available, known as the ‘risk-to-capital’ requirement. This condition has caused several businesses some issues, in an area which is already technically difficult.

As ever there was a reason for the introduction of the test, it being identified that the generous tax relief encouraged a subset of investors and fund managers to use them for ‘capital preservation’ investments. These typically involved investment in lower risk, often asset-based companies that looked to generate stable returns without aiming for significant growth and therefore low risk (think solar panel farms). When the guidance notes were issued on the new condition, more emphasis was given to the future long-term growth of the venture rather than the level of risk. Most tax case decisions on the point have centred on the long-term growth and development objective of the company rather than the risk of loss of capital.

The legislation states that the risk-to-capital condition is only met if, having regard to all the circumstances when the shares are issued, it would be reasonable to conclude that both of the following conditions apply:

- the issuing company has objectives to grow and develop its trade in the long-term; and

- there is a significant risk that there will be a loss of capital greater than the net investment return.

It is not sufficient to show that there is a significant risk of loss; the long-term growth and development objective is given equal weight and HMRC will look to see that the business:

- has an objective of increasing the number of employees and turnover.

- the sources of income (and risks of non-receipt) i.e., not passive income.

- whether the company has or will have or acquire assets that could be used as security.

- the extent to which activities are sub-contracted.

- nature of the company’s ownership or management structure (and whether others participate in it).

- how investment opportunities in the company are marketed; and

- whether these are associated with investment opportunities in other companies.

In the recent case of Valyrian Bloodstock, the company’s activity was the purchase of six horses (as foals) that would be sold on in 2-3 years’ time into racehorse training. Although the Tribunal were satisfied that the activity was high risk, they could find no indication that there was any intention to continue beyond an initial three-year period (and the director of the company had previously used single purpose vehicles for similar bloodstock projects) and therefore the EIS long-term growth and development objective was not met.

It is therefore important when seeking investment and relying on one of the tax incentives schemes, that the business is able to meet the risk to capital test and evidence this with supporting documents, for example a business plan and forecasts. Seeking funding to support a shortfall in working capital or a downturn in business due to the current testing economic conditions, is unlikely to be successful. However, if the funding is to grow, develop a new product or enter a new market, then consideration should be given, if willing to give up equity in the business, and meet the qualifying conditions to consider structuring such that investors can qualify the tax reliefs, and de-risk their investment. It is possible to seek advance assurance from HMRC whether your company will qualify or not, which will give an investor a level of comfort that tax relief is available.

For more details on EIS and SEIS, to see if they can help your business in these testing time, please do not hesitate to contact us.