The new Job Support Scheme will be introduced from 1 November 2020 until April 2021 to protect viable jobs in businesses who are facing lower demand over the winter months due to coronavirus. The employee has to be working part of their weekly contract, however some of the points to the new scheme are similar to the Job Retention Scheme (aka furlough scheme), for example the calculation of usual pay.

Full details are not yet available, as the guidance is still being written, however we have summarised below what we do know from The Chancellor’s announcement and a follow up fact sheet.

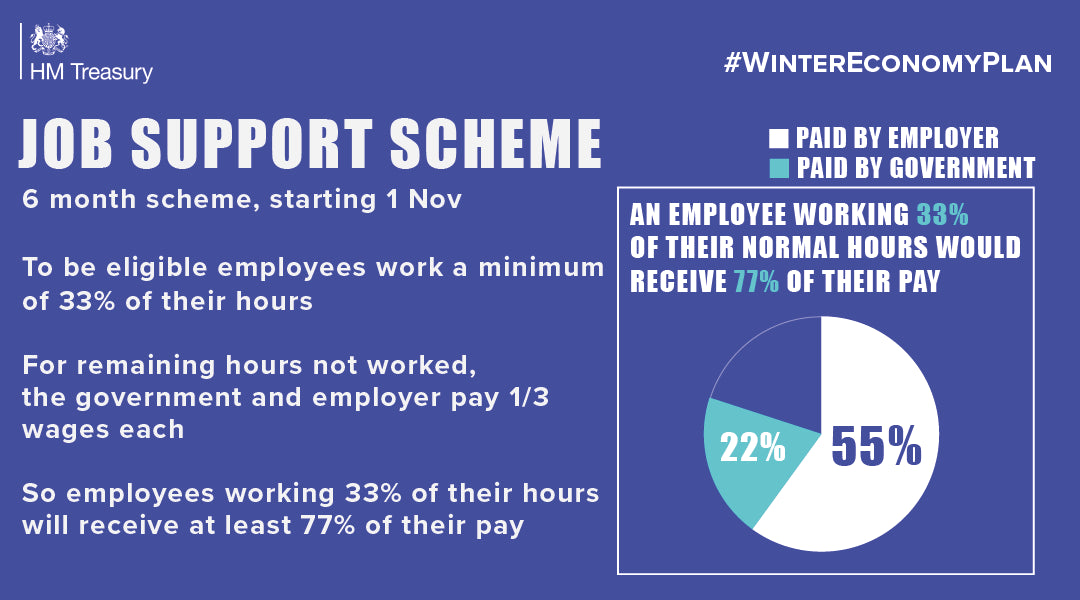

The employers will continue to pay the employee wages for the hours they work, but for the hours not worked, the government and the employer will each pay one third of their equivalent salary. The Government contribution will be capped at £697.92 a month. The scheme will ensure employees earn a minimum of 77% of their normal wages, where the Government contribution has not been capped.

Only employees who can go back to work on shorter time will be paid two thirds of the hours for those hours they can’t work. This looks like that where an employer is forced to close because of coronavirus restrictions, and there are no working hours, the employees could possibly be left without support.

As with the furlough scheme, consent will be required to place employees on the Job Support Scheme. This may be done through the contractual right to vary the contract, or through actual consent, on which employment law advice will be required. Details on what we believe are the required criteria are as below:

Eligibility:

Employers:

- All employers with a UK bank account and UK PAYE schemes can claim the grant;

- Neither the employer nor the employee needs to have previously used the Job Retention Scheme (aka furlough scheme);

- Large businesses will have to meet a financial assessment test, showing their business has been adversely affected by the virus by the fact their turnover has fallen by a third. The government said it also expected that large employers would not pay dividends to shareholders while using the scheme;

- There will be no financial assessment test for small and medium enterprises (SMEs).

Employees

- Employees must be on an employer’s PAYE payroll on or before 23 September 2020. This means a Real Time Information (RTI) submission notifying payment to that employee to HMRC must have been made on or before 23 September 2020;

- In order to support viable jobs, for the first three months of the scheme the employee must work at least 33% of their usual hours. After 3 months, the Government will consider whether to increase this minimum hours threshold;

- Employees will be able to be “on and off” the scheme and do not have to be working the same pattern each month, but each short time working arrangement must cover a minimum period of seven days.

Grant payments will be made in arrears, reimbursing the employer for the Government’s contribution. The grant will not cover Class 1 employer NICs or pension contributions, these contributions will remain payable by the employer.

The normal wage calculations will follow a similar methodology as for the Coronavirus Job Retention Scheme.

Employees cannot be made redundant or put on notice of redundancy during the period within which their employer is claiming the grant for that employee, as the scheme is to retain employees.

HMRC will check claims on submissions. Payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information. Grants can only be used as reimbursement for wage costs actually incurred. We would also expect, as with the Job Retention Scheme, there to be an extended enquiry period following the closure of the claim, so that HMRC can check and audit businesses.

Employers must:

- agree the new short-time working arrangements with their staff;

- make any changes to the employment contract by agreement, and

- notify the employee in writing.

The agreement must be made available to HMRC on request.

Employers using the Job Support Scheme will also be able to claim the Job Retention Bonus (£1,000 bonus to be paid per employee who remains continuously employed through to 31 January 2021) if they meet the eligibility criteria.

A Treasury example of how they see the scheme working:

An employee who normally works 5 days a week and earns £350 a week, is asked to work reduced hours, 2 days a week, (40% of her usual hours), due to a fall in business. Under the Job Support Scheme, the employee will be paid as follows:

- Employer pays £140 for the two days worked;

- For the three days not worked (60%, worth £210), the employee will also be paid 2/3, or £140, bringing total earnings to £280, 80% of her normal wage. The Government paying a grant worth £70 (1/3 of hours not worked, equivalent to 20% of her normal wages).

Further guidance will be provided by HMRC in due course.

A little thought on Job Support Scheme

The Job Support Scheme is much less generous for employers than the furlough scheme, with employers needing to contribute up to 55 per cent of normal wages, compared to 10 per cent currently (in September) and 20 per cent in October. As employers will potentially only be getting 33 per cent of work in return for 55 per cent payment, some employers may not find the option attractive.

Business may need to do some number crunching to work out whether it would be cheaper to make redundancies than bringing high numbers of employees back from furlough, or that it may be more cost effective to bring a few employees back full time, rather than many part-time under the Job Support Scheme.

It's vital that everyone follows the guidelines & remember:

#Hands #Face #Space